The steps to apply for a residential mortgage loan are as follows:

The following are the loan policies of some local banks:

Cathay Bank:

The loan can be up to 70%. You can open a Premier Wealth Management VIP and apply for a home loan after 2 months. The VIP account requires a deposit of 100,000. The loan interest rate is about 3% (the fixed interest rate for the first 5 years of the 30-year loan is 3.125%). The loan can be up to 3 million US dollars.

Citibank:

The loan can be up to 70%. You need to open an account and require a deposit of 50,000 US dollars or more for a house loan.

East West Bank:

The loan is up to 60%. The procedures are the simplest, but the loan interest rate is also high, the loan interest rate is around 5% (the fixed interest rate for the first 3 years of the 30-year loan is 5.25%).

Wells Fargo bank:

The interest rate is the lowest. The 30-year fixed interest rate for 30-year loans is about 4%, but the procedures are relatively cumbersome.

Note: As bank loan interest rates are changing at any time, and bank policies are constantly changing, the above is for reference only. If you plan to apply house loan, please contact our investment consultant as soon as possible. Our investment consultant will assist in account opening and applying loan with the corresponding bank according to your needs.

Monthly payment with different interest rates (based on 30-year mortgage)

| Loan Amount | $ 500,000 | $ 1,000,000 | $ 2,000,000 | |

| Interest Rates | 3% | $2,108 | $4,216 | $8,432 |

| 4% | $2,387 | $4,774 | $9,548 | |

| 5% | >$2,684 | $5,368 | $10,736 | |

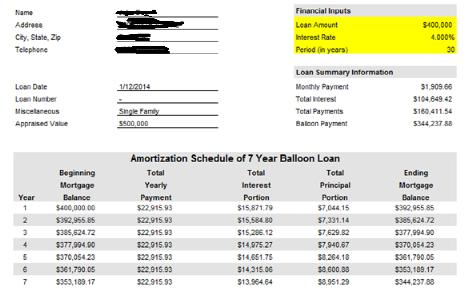

The following is the analysis of a 7-year-term 30-year mortgage loan:

The loan amount is 400,000 US dollars, with a fixed annual interest rate of 4% for 7 years. The so-called 7-year term 30-year amortization refers to the interest that the lender should pay each year according to the 30-year installment. At the end of the 7th year, you can choose to repay the balance or apply for a re-loan. In this example, our borrower needs a monthly payment of US$1,909.66, and a one-time repayment of US$344,200 at the end of the 7th year, or to apply for a re-loan.

In this example, the interest rate for the first 7 years is fixed. Some banks provide floating-rate loans, and interest rates are determined based on the trend of US Treasury bonds. At the beginning of the loan, the interest rate of such loans will be lower than the fixed interest rate. However, due to the changes in the Fed's policy and the unknown economic trend, such loans often have higher interest rates in the later stages. Regarding to the current situation, we recommend that investors consider fixed-rate loans.